Five Days, Five New Highs… So, What Happens Next?

- Caleb S

- Jul 29, 2025

- 3 min read

Last week, the S&P 500 pulled off a neat trick: five consecutive days of new all-time highs. That’s a feat worthy of attention—not just because it's rare, but because it begs the question every market junkie loves to ask: what’s next?

We dug into the history books to find out.

Historical Context: When the Market Can’t Stop Winning

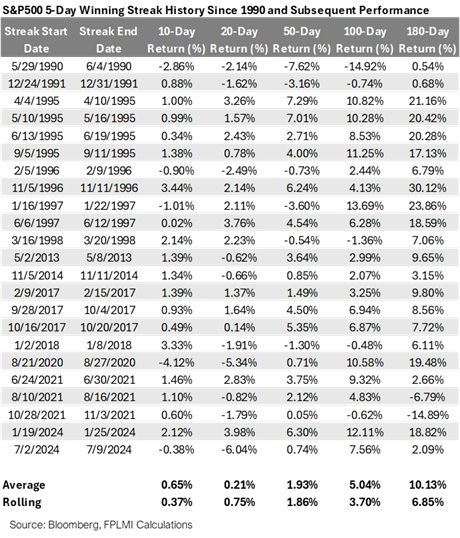

Since 1990, this 5-day all-time-high streak has happened just 23 times. That’s fewer than once every 18 months. We examined each instance and looked at how the market behaved afterward across five forward timeframes: 10, 20, 50, 100, and 180 days.

Here’s what the data said—surprisingly clearly:

1. Short-Term Momentum Is Real

The 10-day return following a 5-day high streak averaged +0.65%, nearly double the 0.37% average of rolling 10-day periods. Call it FOMO, momentum, or “don’t fight the trend”—but when markets heat up, they often stay hot… at least for a little while.

2. The 20-Day Slump

Just as you start to get comfortable, the party quiets down. The 20-day return averages a meager +0.21%, less than a third of the rolling average of +0.75%. This could be a digestion phase. Or maybe investors are catching their breath—and waiting to see if valuations will get a reason to stretch even further.

3. The Long Game Wins

Beyond 50 days, history says staying invested pays off:

- 100-day return: +5.04% (vs. rolling +3.70%)

- 180-day return: +10.13% (vs. rolling +6.85%)

- 91% of the time, the market was higher six months later.

In short: while short-term results can be mixed, longer-term investors were almost always rewarded for sticking with the trend.

Seasonality Says: Beware August and September

The pattern of “strong-now, soft-later, strong-again” fits nicely with one of Wall Street’s oldest clichés: Sell in May and go away, which should probably be amended to say something like - just… “take August and September off,” but that's not quite as catchy.

Since 1990:

- August returns average –0.53%

- September is worse at –0.91%

If your 5-day streak ends in July (like it just did), there’s an extra reason to tread carefully. History and seasonality might be plotting a short-term nap.

Investment Implications: What Should You Do?

This isn’t a call to load the boat—or jump ship. It’s a framework.

If you're a tactical investor:

- A short-term pullback wouldn’t be surprising

- But don’t let it scare you out of the longer-term trend

If you're a long-term allocator:

- Strong momentum paired with improving breadth and earnings revisions is a green light

- The probabilities are in your favor when momentum is at your back

Markets don’t usually ring a bell at the top—or the bottom. But sometimes, they do leave breadcrumbs. A string of new highs is a clue that the probabilities for strength will continue. However, it's always important to keep in mind, this is just on piece of a large puzzle. To put the whole puzzle together investors should go beyond statistical measures and factor in liquidity, valuation, economic momentum, volatility, market technicals and internals.

Disclaimer:

The information contained in this blog post is for informational and educational purposes only and does not constitute investment advice or a recommendation to buy or sell any securities. Past performance is not indicative of future results. All investing involves risk, including the potential loss of principal. The views expressed are those of the author and are subject to change without notice. Nothing in this post should be construed as a solicitation or offer to buy or sell any financial instrument or to participate in any investment strategy. Please consult your financial advisor, tax professional, or legal counsel before making any financial decisions. Focus Point Capital is an investment adviser registered with the State of Colorado. Registration does not imply a certain level of skill or training.

Comments