Tariff Hurricane – Eye of the Storm

- Caleb S

- Apr 28, 2025

- 3 min read

After weeks of relentless negativity fueled by tariff concerns and policy uncertainty from the Trump Administration, financial markets caught a welcome reprieve last week. Encouraged by policy shifts, improving sentiment, and powerful technical signals, investors pushed markets sharply higher.

However, while the rally is supported by historically strong indicators, we believe it is important to approach the current environment with a healthy degree of skepticism. Just as the eye of a hurricane offers a temporary calm, this may represent a pause rather than a full resolution of the underlying issues.

What Drove the Rebound?

1. Policy Reversals and Hope for Resolution

Trump's Pivot: President Trump softened his attacks on Federal Reserve Chair Jerome Powell, easing concerns over political interference in monetary policy.

Fed Support: Several Federal Reserve Presidents made public comments favoring lower interest rates, providing an additional tailwind to risk assets.

Trade Optimism: Hints that the Trump Administration may present concrete solutions for unlocking global trade offered markets a reason to hope for stabilization.

2. Better-Than-Feared Earnings

Early S&P 500 earnings results have come in better than feared, helping ease concerns about an imminent earnings recession.

3. Shift in Global Capital Flows Sentiment

Immediate concerns about a disorderly flight of capital out of the U.S. have faded, replaced by expectations of a slow and gradual reallocation over time.

4. Equities Hitting Key Technical Support Levels

Media coverage emphasized technical support levels that historically have encouraged buying, triggering renewed investor confidence.

5. A Series of Rare and Powerful Technical Signals(Positioned as the final and culminating factor)

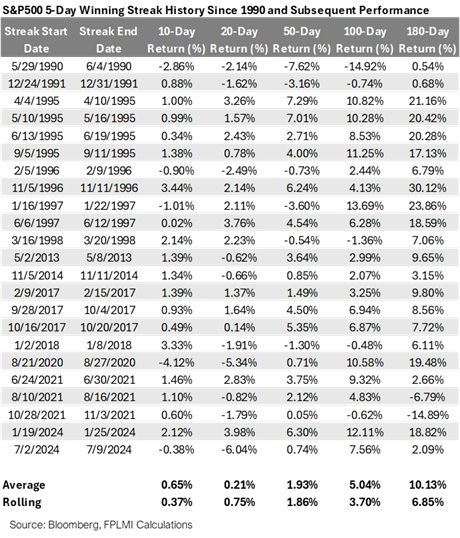

Zweig Breadth Thrust (ZBT) Triggered: On April 24, 2025, the ZBT signal — one of the rarest technical indicators — was triggered. Historically, ZBT events (only 18 since 1945) have preceded strong average 6- and 12-month gains of 15.3% and 24%, respectively.

"Bear Killer" VIX Signal: A spike in the VIX above 50 followed by a sharp drop below 30 triggered the so-called "bear killer" signal. Past instances have consistently led to strong positive returns over the following year.

Back-to-Back 90% Advancing Days: Markets registered two consecutive days where over 90% of stocks advanced — a breadth thrust seen at major historical turning points like 2009, 2011, and 2020.

High-Yield Bond Spread Recovery: High-yield bond spreads, which had widened on tariff fears, narrowed meaningfully — suggesting reduced recession risk and an improving risk appetite.

Death Cross Amid Waterfall Sell-off: Although a "death cross" is often perceived as a bearish sign, its occurrence during a rapid market decline has, historically, often marked final washout phases and set the stage for recoveries.

Why We Remain Cautious

While the combination of these developments presents a compelling case for a rally, it is important to recognize that skepticism is warranted.

Key points tempering our enthusiasm:

The structural damage from tariffs to global trade flows, corporate margins, and consumer demand remains difficult to assess in real time.

Policy uncertainty remains high and could reaccelerate with little warning.

Forward earnings expectations continue to drift lower, despite early earnings season surprises.

Liquidity stresses, while currently easing, have not disappeared entirely.

In short: while the recent signals should not be ignored — and in the past have marked important inflection points — we view the current situation as a potential beginning, not a guarantee. Risk management remains critical as markets work through what could be a volatile transition period.

Comments