Don’t Be Fooled by the Rally: Why the Third-Largest One-Day Market Surge Isn’t a Signal to Buy

- Caleb S

- Apr 15, 2025

- 2 min read

Wednesday’s explosive market surge — now ranked as the third-largest one-day rally since World War II — was a powerful wake-up call for anyone betting against the market. Dubbed a “rip-your-face-off” rally by traders, the move wasn’t driven by improving fundamentals or a shift in economic momentum. Instead, it was triggered by a sudden policy pivot, highlighting how today’s markets are governed more by headlines than trends.

With volatility driven by the latest whisper from inside Trump’s advisory circle, investors are left navigating markets that can swing wildly — not because of long-term outlooks, but because of the day’s policy speculation.

Why “Missing the Best Days” Is a Misleading Metric

In the aftermath of a large rally, media outlets often repeat a familiar refrain: “If you miss the best days in the market, your returns will suffer dramatically.” This claim is typically used to encourage investors to remain fully invested regardless of market conditions.

But this narrative misses an important truth: many of the largest market rallies happen during bear markets or recessions. As the chart below shows, several of the strongest one-day gains in history occurred while the market was still declining overall. Staying invested during these periods may expose portfolios to substantial drawdowns rather than delivering long-term gains.

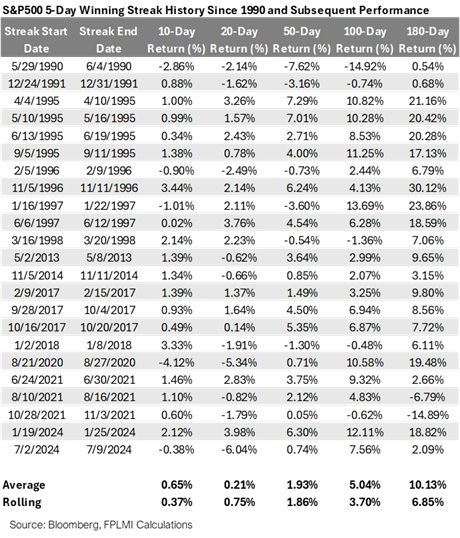

What the Data Says

We’ve compiled a table of the largest one-day market rallies post-WWII, along with a chart ranking them by size and context. What stands out is that sharp rallies are not necessarily signs of recovery — they often occur in the middle of prolonged market declines.

This data challenges the conventional wisdom and underscores a core belief behind our approach: managing risk matters more than riding out every bump in the road.

Key Takeaways for Investors

Markets remain reactive, not predictive — Policy-driven news, especially from unpredictable sources, can drive massive short-term volatility.

Big rallies aren’t always bullish — History shows they frequently occur during bear markets.

Stay strategic, not static — Rather than staying invested blindly, align exposure with the current risk environment.

Comments